What is the makeup of your retirement accounts? ( kbin.social )

What are you invested in? Target date funds, ETFs, individual stocks? Do you think of your portfolio as aggressive, neutral, or conservative?...

What are you invested in? Target date funds, ETFs, individual stocks? Do you think of your portfolio as aggressive, neutral, or conservative?...

General financials:...

My family uses credit cards for all purchases and we pay them off in full each month. Although sometimes we’ll use a 0% APR promotion for bigger purchases....

I’ve been using You Need a Budget for family budgeting and I like it but it is expensive. I’ve played with Buckets a little bit and looks like a contender. Anyone move from YNAB to Buckets?

I’m talking about types of accounts, automatic transfers, etc. Feel free to mention specifics, but I’m more interested in higher level information like does your paycheck go to savings or checking, do you use automatic transfers, do you use a traditional bank account or something different, etc....

Interest will start accruing again on September 1, after rates were effectively set to 0% since March 2020 for federal student loans. Now, interest rates, which are fixed and vary by loan, will return to the same rate they were before the freeze....

I’m a long time PocketSmith user currently switching to Quicken. PocketSmith is a decent product but has some glaring issues that don’t seem to be on their radar and I feel like my finances have honestly become too complex for PocketSmith’s simplistic philosophy....

Definitely a trend I see around me (Europe, 30 years old)....

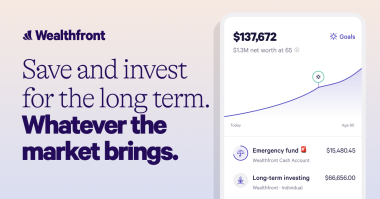

A buddy of mine told me about Wealthfront recently and they’re 5% money market account rates....

Following the credit card thread, I’ve learned that some people use credit card points and miles to pay for hotels, that seems pretty interesting....

Many steps remain before older adults see the benefit of the Centers for Medicare and Medicaid Services’ upcoming talks with drugmakers.

Hello everyone,...

Legislation known as the Credit Card Competition Act, first introduced in Congress in 2022, is described by its sponsors as encouraging “competition in electronic credit transactions.” But if lawmakers end up passing the measure, opponents say it could also torpedo the rich rewards and perks that cardholders have enjoyed for...

I am looking for a target-maturity bond ETF for UK Gilts but I couldn’t find any by using an internet search engine. I would like something similar to iShares iBonds Dec 2033 Term Treasury ETF but for UK Gilts instead of US treasury bonds. Does such an ETF exist? If not, what are the practical alternatives for getting UK...

Intro...

This is technically a question specific to Canada but maybe it can be applied to other countries as well....

Hello everyone,...

Hello! I am looking for some suggestions on supplemental income while I am job hunting. Unfortunately I had to leave my career unexpectedly due to incessant racism and discrimination....

My family needs a second car. I’m thinking about a used Chevy Bolt or Nissan Leaf so I think the cost will be about $20,000....

Curious to see how the community deals with this kind of situation

Our (spouse and I) are in a few of these funds. Is there a retirement calculator that figures out projections of these always-adjusting funds?...

More than 1 in 4 car shoppers in Texas and Wyoming have committed to paying more than $1,000 a month, and experts say it is due to the high volume of large truck purchases in those states, according to a report by auto site Edmunds....

Americans’ credit card balances rose briskly in the second quarter, hitting a sobering milestone of more than $1 trillion, the Federal Reserve Bank of New York reported this month. Credit cards are the most prevalent type of household debt, New York Fed researchers wrote in a blog post, and saw the biggest increase of all debt...