What are your best tips to save money?

Following the credit card thread, I’ve learned that some people use credit card points and miles to pay for hotels, that seems pretty interesting....

Following the credit card thread, I’ve learned that some people use credit card points and miles to pay for hotels, that seems pretty interesting....

The US government is telling everybody that inflation is 3.4% per year. That is not correct. Try 14.2% and that's about right. Source : gold/usd 1 year simple moving average.

Most people take a simple view of cash: they have a checking account for spending and a savings account for savings, and if they get fancy, they’ll have a CD for longer term savings goals. Power users will change to an online bank with better returns, and that’s about as far as it goes. That certainly works, but we can do a...

As the title says I am trying to see where people stand on this. Obviously this is all personal preference. But that is what I am after....

Legislation known as the Credit Card Competition Act, first introduced in Congress in 2022, is described by its sponsors as encouraging “competition in electronic credit transactions.” But if lawmakers end up passing the measure, opponents say it could also torpedo the rich rewards and perks that cardholders have enjoyed for...

Hello everyone,...

cross-posted from: lemmy.world/post/3560407...

After years of Mint I’ve decided to look for other options. Im considering doing it myself in a spreadsheet but before I go that route (not ideal) I thought I’d see if anyone had recommendations on good basic family-budget apps. Would be great if it could link with bank accounts but I’m open to anything at this point.

I’ve had a few people in my life tell me that they lost X % of their 401k during the (insert financial crisis)....

cross-posted from: lemmy.ca/post/3527160...

A Vanguard video (m.youtube.com/watch?v=1nprZjV_6FM) refers to 4 budgeting methods...

Hi everyone, I recently landed a new job where the base 401(k) contribution for all FTEs is 12% of your salary. This is regardless of your contribution, with no additional match. I realize that this is unusual for most people and it is for me as well. In my last job, I got up to a 6% match so I maxed that out and didn't think on...

For four decades, patient savers able to grit their teeth through bubbles, crashes and geopolitical upheaval won the money game. But the formula of building a nest egg by rebalancing a standard mix of stocks and bonds isn’t going to work nearly as well as it has.

cross-posted from: lemmy.ml/post/10623652...

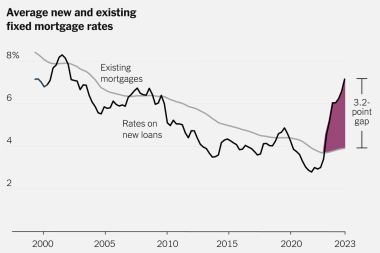

The central banks of the world are guiding us to a perfect crash landing. Interest rates have remained elevated in an attempt to curb the inflation brought on by printing excessively during 2020 and 2021. This strategy has actually worked by reducing US inflation from over 9% at the beginning of the year to around 3.5% now,...

I’m talking about types of accounts, automatic transfers, etc. Feel free to mention specifics, but I’m more interested in higher level information like does your paycheck go to savings or checking, do you use automatic transfers, do you use a traditional bank account or something different, etc....

Here’s an archived version of the page....

Hello everyone,...

Baby boomers anticipate that 47% of pre-retirement earnings will be replaced by Social Security, according to results of an annual survey from the Nationwide Retirement Institute. But the reality for someone making what the Social Security Administration considers the average wage in recent years, about $60,000, is more like...

Hello everyone,...